8 Best Personal Loans of January 2024

Online lending platforms, credit unions, and conventional banks offer personal loans. Few lenders offer loans up to $100,000, and most offer amounts between $1,000 and $50,000. However, according to a Forbes Advisor survey, more than 70% of Americans borrow less than $20,000. Additionally, many personal loans can be funded in a few business days, saving you time and money if you need it.

Best Personal Loans of 2024

SoFi – Best Overall Personal Loan

LightStream – Best for Low Interest Rates

LendingPoint – Best for Fast Funding & Below-Average Credit

Upgrade – Best for Bad Credit

Universal Credit – Best for Comparing Multiple Offers

Discover – Best for No Interest If Repaid Within 30 Days

Upstart – Best for Loans as Low as $1000

Avant – Best for Range of Repayment Options

Why We Picked It

Every state offers unsecured fixed-rate personal loans through the online lending platform SoFi. Since its founding in 2011, SoFi has provided more than $50 billion in loans. It is notable for permitting large loan amounts and offering extended loan terms.

With loan amounts ranging from $5,000 to $100,000, SoFi is an excellent choice for people with good credit who need to borrow a significant sum. Your state may impact the available loan amounts. With repayment terms ranging from two to seven years, SoFi is an exceptionally flexible choice for people with good credit (minimum 650) and a minimum annual income of $45,000. Prospective borrowers may also submit joint applications through SoFi, though co-signers are not allowed.

As a reward, approved borrowers receive relatively low APRs. Furthermore, SoFi does not impose origination, late, or prepayment penalties. This is noteworthy given that personal loan lenders frequently impose minimum origination or late payment fees.

If you're considering getting a debt consolidation loan from SoFi, remember that the lender will not pay the borrower's other creditors directly. This implies that you will have to repay each of your other lenders separately after the loan proceeds are deposited into your bank account. Customers can also take advantage of the platform's various benefits and discounts, such as unemployment insurance and an annual payment date modification option.

Why We Picked It

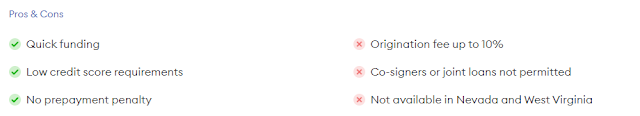

The LendingPoint online lender provides personal loans to applicants in the 48 states and Washington, D.C.; it does not provide loans in West Virginia or Nevada. Potential borrowers can apply online and get funding quickly in states where they qualify.

The minimum loan amount for a Georgia loan is $3,500; the

range of LendingPoint personal loans is $2,000 to $36,500. Repayment periods

vary from two to six years or 24 to 72 months.

LendingPoint's two primary drawbacks are its high maximum

APRs and origination fees. Although a high credit score usually helps

you avoid high APRs, your state may have origination fees (up to 10%) for

LendingPoint.

Details

Eligibility: To qualify for a personal loan from LendingPoint, you must reside in one of the 48 eligible U.S. states or Washington, D.C., and have a minimum credit score of 600. Prospective borrowers in Nevada and West Virginia are not eligible for loans.

Time to approval: Your funds may be sent to you as soon as the following business day.

Details

Eligibility: The average Discover borrower has a score of

750, but prospective borrowers must have a minimum score of 660 to be eligible

for a personal loan. Candidates do not need a certain amount of credit

history to apply to Discover. In addition, candidates must show that their

household makes at least $25,000 annually; however, average income is not

revealed. Discover also assesses each applicant's credit history, current credit activity, and previous credit inquiries. Co-applicants and

co-signers are not accepted.

Uses for loans: Discover personal loans are available for

auto repairs, pet emergencies, medical expenses, medical emergencies, adoption

and fertility costs, and financial emergencies. Discover loans are not limited

to covering personal expenses; they can also be used to pay for small-business

expenses. Consumers are not permitted to use Discover loans for unlawful

activities, to settle off secured debt, or to fund postsecondary education.

Time to decision: Most applicants get a decision the same

day. If the loan was funded on a weekday, funds could be disbursed as early as

the following business day, provided the application is free of typos and

other errors. If not, borrowers might have to wait up to seven days to get

their loan money. When a loan is used for debt consolidation, Discover may also

distribute money directly to creditors not affiliated with the

borrower.

Why We Picked It

Upstart's use of artificial intelligence and machine

learning in its borrower qualification process has allowed it to leave its mark

in the personal loan market. In fact, Upstart calculates that it has approved 27% more borrowers than would have been feasible with a conventional lending model. Despite its competitive APRs, Upstart is not the best lender for borrowers who can qualify for more favourable rates. Even so,

people with fair credit can still use the platform because it requires a

minimum credit score of 300.

With loan amounts ranging from $1,000 to $50,000, Upstart

also provides a relatively flexible range of loan options, ensuring that you don't

borrow (or pay interest on) more than you need. Furthermore, even

though Upstart has a lower loan cap than some lenders, many potential borrowers

may find this sufficient.

Although Upstarts' three-, five-, and seven-year loan terms are more stringent than those of other lenders, applicants who might not be accepted in a more traditional lending environment will probably find it to be a fair trade-off. It is accessible in all states save West Virginia and Iowa and just as widely accessible as many other leading

lenders.

Details

Eligibility: Upstart distinguishes itself by assessing

borrower applications using an AI-based platform based on a variety of nontraditional factors. Moreover, Upstart may only accept applicants with a sufficient

credit history to have a score, even though the platform lists a minimum credit

score of 300. Upstart considers the student's college degree, employment history, place of residence,

debt-to-income ratio, bankruptcies and delinquencies, and the number of credit

inquiries.

Additionally, borrowers must have a regular part-time job, a

full-time job offer beginning in six months, or another source of income with a

minimum annual income of $12,000. Co-applicants and co-signers are not

accepted.

Uses of loans: Credit card and other debt consolidation,

special occasions, relocation and moving expenses, dental and medical expenses,

and home renovations are all eligible uses for personal loans from Upstart.

Upstart allows borrowers to use the proceeds of their personal loans to pay for

educational expenses, something that many other traditional and online lenders

do not (except in California, Connecticut, Illinois, Washington and the

District of Columbia).

New borrowers are not permitted to use personal loans to

finance unlawful activity or to buy illicit drugs, weapons, or other firearms.

Time to completion: Borrowers whose loans are approved by

Upstart before 5 p.m. Eastern time, Monday through Friday, can expect funding

the following business day. After 5 p.m., approved loans are usually

funded the next business day or the day after. According to Upstart, 99% of loan applicants receive their money one business day after agreeing to the

loan terms. After accepting a loan, it may take three business days

to process loans for educational costs.

Why We Picked It

Avant is a Chicago-based consumer lending platform established in 2012. It provides both secured and unsecured personal loans via

WebBank, a third-party bank. Every state, except Hawaii, Iowa,

New York, Vermont, West Virginia, and Maine, offers unsecured loans, as does

Washington, D.C. The platform only requires a minimum score of 580 to qualify,

and it specializes in middle-class borrowers with fair to good credit.

Although the maximum loan amounts are lower than those other lenders offer, borrowers can still take advantage of the flexible

repayment terms (two to five years) and low minimum amount. Avant personal

loans do have a fee, much like many loans for subprime borrowers. Avant

charges an administrative fee of up to 4.75% of the loan amount in addition to

having an APR range for applicants with good to excellent credit that is on the

high side (9.95% to 35.99%), and there is no autopay discount. Even so, the

platform receives high marks from borrowers who require fast access to funds

but have less-than-perfect credit.

In April 2019, Avant and the Federal Trade

Commission (FTC) reached a $3.85 million settlement. The lawsuit was filed in

response to claims that Avant, among other things, charged consumers interest

and late fees that they did not owe and collected payments from customers

without authorization or in amounts more significant than permitted, according to FTC

documents. We did not hear back from Avant when we contacted them to inquire

about any changes they had made to their practices following the settlement.

Avant has a stellar 4.7-star rating on Trustpilot despite this.

Details

Eligibility: Avant targets various clients, including those with fair

credit, to receive credit services. Because of this,

Avant requires a minimum credit score of 580, with borrowers typically scoring

between 600 and 700. Similarly, Avant targets borrowers with low to

middle-class incomes and only requires a $20,000 minimum, even though the

majority of borrowers make between $40,000 and $100,000 annually on average as

a family.

To broaden eligibility, Avant may also consider the income of other household members in addition to employment income, such as alimony and child support. Nevertheless, Avant does

not accept co-applicants or co-signers.

Loan purposes: Avant loans, like those from many other

personal loan providers, can be used to pay for medical costs, auto repairs,

home renovations, relocation, vacations, and other events, as well as to

consolidate debt. The platform does allow current borrowers to refinance their

current Avant loans with another loan—possibly with a lower APR—but Avant

borrowers are not permitted to use personal loan funds to cover business expenses.

Time to completion: Avant applicants who are approved for an unsecured loan by 4:30

p.m. Central time, Monday through Friday, may receive their funds the following business day. However, just like with other lenders, the

borrower's bank determines how quickly money is funded. Additionally, it might

take longer for borrowers to obtain secured loans.

*Some loan amounts and APRs are only available for specific loan uses.

As of January 3, 2023, the rates and information for personal loans mentioned above are correct. The annual percentage rates (APRs) and loan specifics may have changed since the page was last updated, even though we routinely update this information. Remember that some lenders only offer particular terms and rates for specific loan purposes. Before applying, check the available APR ranges and loan details with your lender based on your intended loan purpose.

Tips for Comparing Personal Loans

Consider these tips when comparing personal loans:

Make every effort to prequalify. Potential borrowers can prequalify for a loan from several personal loan providers. This implies that the applicant can determine what kinds of loan amounts, rates, and repayment terms they are likely to qualify for by providing information about their financing needs, income, housing situation, and other pertinent details. Better yet, you can shop around without negatively affecting your credit score because this process usually only necessitates a soft credit inquiry.

Think about the reason behind your loan. Though they can be used for many things, personal loans can only be used for things like consolidating consumer debt, making home improvements, going on vacation, paying for weddings and funerals, making large purchases, and other personal expenses. Because of this, lenders frequently prohibit using personal loans for, at the very least, unlawful activity, business needs, and postsecondary education expenses. Verify that the borrower agreement for the lender you are considering permits you to use the loan for the purposes you have in mind.

Look out for any additional costs. Specific lenders provide fee-free personal loans, meaning borrowers are exempt from origination fees, late payment penalties, prepayment penalties, and other typical loan expenses. Asking about fees is crucial when looking for the best loan terms, though this is more of an exception than the rule. Find out if an origination fee is included in the APR or deducted from the loan amount before funding if a lender charges one, as this could affect the loan amount you need to request.

Analyze the lender's customer service offerings. Before

you sign the loan agreement, one more thing to consider: if you have

located a lender willing to give you the money you need on terms that work for

you. Customer service can make a big difference if you run into payment

problems or experience financial hardship during your loan repayment period,

even though it might not seem like a big deal during the honeymoon phase of

your loan. To ensure it's a good fit, check out the lender's customer

service options and read testimonials from previous and present borrowers.

Pro Tip

Some lenders limit how you can use funds, so check lender rules for acceptable personal loan uses when comparing personal loan options. For instance, you might be unable to use a personal loan to cover a down payment on a home, business expenses, or college tuition. However, you can use the money from a personal loan to pay off debt or cover significant expenses like medical bills or home improvement costs.

0 Comments